Buy-to-Let Mortgages

The best place to find landlord financial services and information Simpler, clearer, faster

Buy-to-Let is fun! Buying your next rental property can be stressful.

You don't have to figure it out by yourself. Our Buy-to-Let Mortgage Advisers will help you find the best mortgage deal, explain the different options and assist you in every stage of your landlord journey.

The rules around landlord finance can be complicated from unusual properties, rental stress tests, limited company buy to let and more so for portfolio landlords. Your circumstances can limit options from minimum income, credit score and experience.

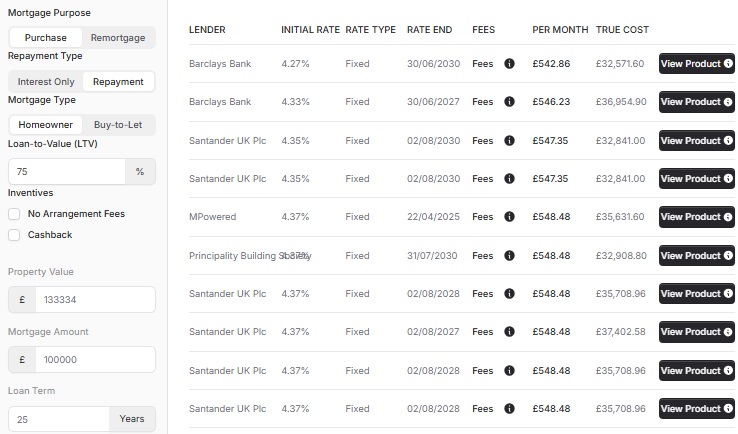

Lowest Buy-to-Let (BTL) Mortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

4.34%

2 Year Fixed

TBC

TBC

Fixed

at

4.34%

|

|

|

|

4.34%

5 Year Fixed

TBC

TBC

Fixed

at

4.34%

|

|

|

|

4.39%

2 Year Fixed

TBC

TBC

Fixed

at

4.39%

|

|

|

|

4.39%

2 Year Fixed

TBC

TBC

Fixed

at

4.39%

|

|

|

|

4.39%

5 Year Fixed

TBC

TBC

Fixed

at

4.39%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £142858 property value, a £100000 loan amount and £42858 deposit. A Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

4.34%

2 Year Fixed

TBC

TBC

Fixed

at

4.34%

|

|

|

|

4.34%

5 Year Fixed

TBC

TBC

Fixed

at

4.34%

|

|

|

|

4.39%

2 Year Fixed

TBC

TBC

Fixed

at

4.39%

|

|

|

|

4.39%

2 Year Fixed

TBC

TBC

Fixed

at

4.39%

|

|

|

|

4.39%

5 Year Fixed

TBC

TBC

Fixed

at

4.39%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £133334 property value, a £100000 loan amount and £33334 deposit. A Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

4.99%

2 Year Fixed

TBC

TBC

Fixed

at

4.99%

|

|

|

|

5.10%

5 Year Fixed

TBC

TBC

Fixed

at

5.10%

|

|

|

|

4.65%

2 Year Fixed

TBC

TBC

Fixed

at

4.65%

|

|

|

|

4.80%

5 Year Fixed

TBC

TBC

Fixed

at

4.80%

|

|

|

|

4.84%

5 Year Fixed

TBC

TBC

Fixed

at

4.84%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £125000 property value, a £100000 loan amount and £25000 deposit. A Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

6.14%

2 Year Fixed

TBC

TBC

Fixed

at

6.14%

|

|

|

|

6.19%

5 Year Fixed

TBC

TBC

Fixed

at

6.19%

|

|

|

|

6.39%

2 Year Fixed

TBC

TBC

Fixed

at

6.39%

|

|

|

|

6.39%

5 Year Fixed

TBC

TBC

Fixed

at

6.39%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £117648 property value, a £100000 loan amount and £17648 deposit. A Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

🔷What is a buy-to-let mortgage?

If you intend to buy (or remortgage) a property to rent it out you will need a buy-to-let mortgage. The difference compared to a residential mortgage is consent to rent it out. Also, the loan amount derives from the rent instead of your personal affordability. You may need a specific type of mortgage - HMO Mortgages allow you to rent a single house to multiple tenants. A Limited Company mortgage allows you to buy in the name of a company.

🔷How do I Compare Mortgages?

With public tools, it is very difficult for you to compare mortgages without the assistance of a mortgage advisor. It is difficult to know what you can or can not qualify for. Our mortgage advisers will help you assess the market. Find the best mortgage available. With years of personal experience and our knowledge bank, we can disqualify lenders. This helps prevent false starts. There are many ways to compare the best mortgage for you. Wanting low fees such as low arrangement fees, valuation fees or solicitors fees can be one criteria. Others may be rate driven, looking for the best mortgage rate. Most landlords are looking to "total to pay" over the initial term. Finding the lowest amount of fees, rates, etc all added up to compare the lowest you will pay over the initial term.

🔷Is buy-to-let worth it?

The investment is not unlike any others - you can make good returns or you may make a loss from property downturns, low rental demand or bad tenants to give a few examples. Many investors like buy-to-let as it is a brick & mortar investment, you have a physical asset to show for your investment. One that has the possibility to be resold at a loss, break-even or profit depending on market conditions. An asset that if chosen wisely will give you monthly returns on your investment. It can also be hands-on, you can talk to your tenants and provide a good service. You can invest time to renovate the property. Your efforts can affect the bottom line.

🔷Talk to our Buy-to-Let Mortgage Advisers

-

Buy-to-Let Mortgage >

Dive into property investment with our Buy-to-Let Mortgage, tailored for both seasoned investors and first-timers seeking to build a profitable portfolio.

-

Buy-to-Let Remortgage >

Maximize your investment with Buy-to-Let Remortgage, ensuring optimal returns by refinancing your property portfolio with competitive rates.

-

Buy-to-Let Rate Switch >

Enhance your property investment strategy with a Buy-to-Let Rate Switch, ensuring you stay competitive in the market with a smart financial move.

-

Buy-to-Let Company Mortgage >

Optimize your property portfolio's potential with a Buy-to-Let Mortgage in your SPV Company Name, combining strategic investments with simplified financial structures.

-

Portfolio Mortgages >

Grow and diversify your property portfolio with our Portfolio BTL Mortgages, offering tailored solutions for seasoned investors aiming for prosperity.

-

Holiday Let Mortgage >

Transform your vacation home investment dreams into reality with a Holiday Let Mortgage,

-

HMO Mortgage >

Unlock the potential of shared living spaces with our HMO Mortgage, tailored to support your investment in Houses in Multiple Occupation.

-

HMO Company Mortgage >

Elevate your HMO investment strategy with our HMO Mortgage in your SPV Company Name, combining strategic planning with streamlined financial structures.

-

HMO Remortgage >

Revitalize and optimize your HMO investment with a strategic HMO Remortgage, ensuring your shared living spaces remain lucrative in the market.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX