Bank of England Housing Update (May 2025)

Bank Base Rate cut to 4.25%

At its meeting on May 8th, 2025, the Monetary Policy Committee (MPC) voted by a majority of 5 to 4 to reduce the Bank Rate to 4.25% from 4.50%. At the previous MPC meeting in February, they decided to reduce the bank base rate to 4.5%

Two members (Swati Dhingra and Alan Taylor) preferred to reduce Bank Rate by 0.5 percentage points, to 4%. Two members (Catherine L Mann and Huw Pill) preferred to leave Bank Rate unchanged, at 4.5%.

The market did anticipate this reduction, with mortgage lenders recently reducing mortgage rates and SWAP rates coming down in anticipation.

The next Monetary Policy Committee (MPC) meeting will be on June 19th, followed by a full Monetary Policy Report on August 7, 2025.

See: How does mortgage lender funding affect your mortgage price?This is good news for

- Remortgaging Homeowners who need to remortgage as their initial rate ends.

- First Time Buyers trying to meet higher affordability requirements.

- Landlords are hoping not to increase rents due to increased mortgage costs.

Leeds Building Society Economist, Martin Temple adds:

[This] won’t have a direct impact on other mortgage rates, as market pricing has already adjusted on the assumption that this would happen.

Markets currently expect bank base rate to be reduced by another 0.25% in August and again in November. Until there is greater clarity over how the UK economy is performing, including the potential persistence of inflation, we continue to expect members of the monetary policy committee to act in a cautious manner with respect to future decisions on interest rates.

Inflation

Inflation is at 2.6%, slightly higher than the Bank of England target of 2%, from a peak of over 11% in 2022.

We expect an increase in inflation this year. It is likely to rise temporarily, to 3.7%, partly because of higher energy prices. Inflation is likely to rise to 3.7% by September. This is partly because of increases in energy prices, and increases in some regulated prices such as water bills.

Inflation is expected to fall back to the 2% target after that.

UK inflation could be affected by a wide range of factors such as shifts in trade patterns, supply chain disruptions in the UK and abroad, and movements in global exchange rates. It was possible that the ultimate net effect of these developments could be materially more disinflationary for the UK than in the baseline forecast, but it was also possible that the effect could be slightly inflationary in the longer term.

Bank of England on Housing

Annual housing investment growth is expected to strengthen to 5% in 2026 and to 6% in 2027, in part reflecting a positive impact from planning reforms over time.

Restrictive monetary policy has weighed on housing market activity and house price inflation, but these have picked up since their troughs in 2023.

Monthly mortgage approvals for house purchases are currently just above their 2012–19 average. And having been broadly flat over 2023 and early 2024, house prices have since risen.

Building of private housing is marginally ahead but down in social housing. Planning, utility connections, costs and some labour shortages continue to be cited as constraints on growth

Estate agents reported a slightly improving outlook with an increase in activity ahead of stamp duty increases. The exception was the top end of the market where demand has slowed noticeably.

House prices are forecast to increase by low single digit percentages this year.

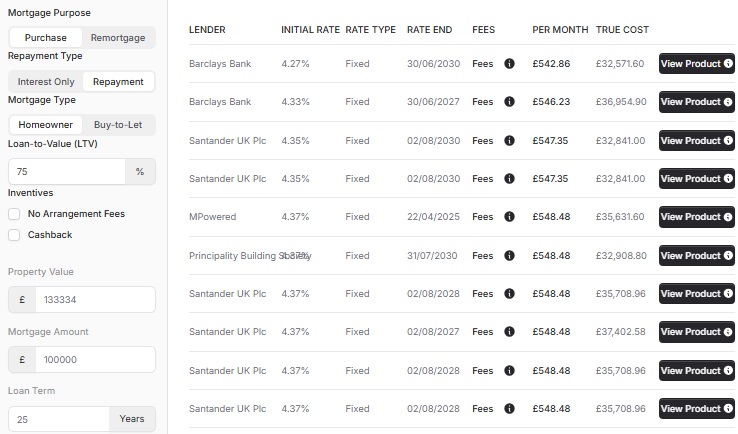

Quoted rates on two-year fixed-rate mortgages with loan to value (LTV) ratios of 75% and 90% have responded as expected to changes in OIS rates, falling by around 20 basis points and 35 basis points, respectively, since January 2025.

Effective rates on new mortgages with a fixed-rate period of between two and five years, which represent around 60% of the mortgage stock, remain around 130 basis points higher than the corresponding rates on outstanding mortgages

While monetary policy is judged still to be weighing on household consumption growth through the cash-flow channel, that effect is likely to be waning as rises in effective mortgage rates have slowed.

The spread between the effective rates paid on new and outstanding mortgages has narrowed since 2023 and has turned negative for mortgages with a fixed period of up to two years. This means that fixed mortgage rates have been decreasing for some households.

Some of the impact of increases in effective interest rates on households’ monthly mortgage payments over recent years has been mitigated by mortgagors choosing to increase the overall term of their mortgages. Over half of new mortgage lending now takes place at a term of 30 years or more, compared with around 30% in 2015

Bank of England on Renting

Rent inflation continues to slow, although supply remains tight. Landlords continue to exit the market with the upcoming Renters Reform Bill causing particular concern for those with houses of multiple occupancy and student let portfolios.

See: MPC May 2025: Summary See: MPC May 2025: ReportHousing associations are awaiting the outcome of the government spending review before committing to building plans in the medium term. Contacts report more instances of increases in rent arrears and tenants struggling with the cost of living. This means that households are facing higher interest rates when they come to refinance, which in turn is pushing up the effective interest rate on the average of all outstanding UK mortgages.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX