Limited Company HMO Mortgages

The best place to find landlord HMO Company Finance simpler, clearer, faster

You can buy an HMO Property in a Limited Company. With benefits to taxation and more control. Landlords invest in HMO in a limited company for various reasons. A minority of Mortgage Lenders offer HMO Mortgages. A smaller minority offering Limited Company HMO Mortgages. In addition, many are only available via Mortgage Advisers. Thankfully More and More specialist mortgage lenders are entering the market.

Lowest Limited Company HMO Mortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

5.74%

5 Year Fixed

TBC

TBC

Fixed

at

5.74%

|

|

|

|

5.84%

5 Years Fixed

5

Years

Fixed

at

5.84%

|

|

|

|

5.89%

5 Years Fixed

5

Years

Fixed

at

5.89%

|

|

|

|

5.94%

5 Years Fixed

5

Years

Fixed

at

5.94%

|

|

|

|

5.80%

5 Years Fixed

5

Years

Fixed

at

5.80%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £142858 property value, a £100000 loan amount and £42858 deposit. A Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.74%

5 Year Fixed

TBC

TBC

Fixed

at

5.74%

|

|

|

|

5.84%

5 Years Fixed

5

Years

Fixed

at

5.84%

|

|

|

|

5.89%

5 Years Fixed

5

Years

Fixed

at

5.89%

|

|

|

|

5.94%

5 Years Fixed

5

Years

Fixed

at

5.94%

|

|

|

|

5.80%

5 Years Fixed

5

Years

Fixed

at

5.80%

|

|

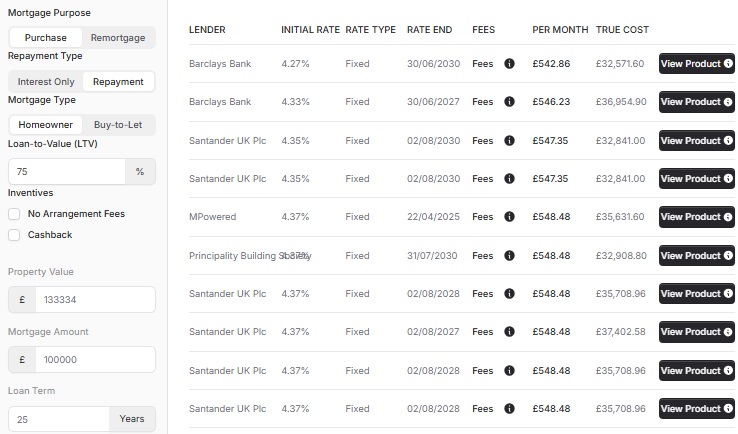

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £133334 property value, a £100000 loan amount and £33334 deposit. A Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.58%

2 Year Fixed

TBC

TBC

Fixed

at

5.58%

|

|

|

|

6.69%

2 Years Fixed

2

Years

Fixed

at

6.69%

|

|

|

|

6.69%

5 Years Fixed

5

Years

Fixed

at

6.69%

|

|

|

|

4.84%

2 Years Fixed

2

Years

Fixed

at

4.84%

|

|

|

|

5.84%

2 Years Fixed

2

Years

Fixed

at

5.84%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £125000 property value, a £100000 loan amount and £25000 deposit. A Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

5.58%

2 Year Fixed

TBC

TBC

Fixed

at

5.58%

|

|

|

|

6.69%

2 Years Fixed

2

Years

Fixed

at

6.69%

|

|

|

|

6.69%

5 Years Fixed

5

Years

Fixed

at

6.69%

|

|

|

|

4.84%

2 Years Fixed

2

Years

Fixed

at

4.84%

|

|

|

|

5.84%

2 Years Fixed

2

Years

Fixed

at

5.84%

|

|

The mortgage products shown are for illustrative purposes only and were generated 0 seconds ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £125000 property value, a £100000 loan amount and £25000 deposit. A Initial Fixed Rate on a interestOnly loan, and a 25-year mortgage term.

🔷Can I buy an HMO in a Limited Company?

Yes, though specific mortgage lenders.

The mortgage products differ from standard buy-to-let mortgages and standard HMO Mortgages. We can help you find the best mortgage for your specific circumstances.

Like a standard mortgage, you will be assessed based on your circumstances. This allows a Brand New Limited Company to be set up.

Mortgage Lenders prefer companies that only own and rent properties. They dislike trading companies doing other activities. However, a trading company can lend funds to a property company for the deposit.

Whatever the reason to buy in a Limited Company. You'll want to discuss this with your accountant to see if it will put you in a better position.

🔷What deposit is needed for a Limited Company HMO?

The minimum HMO Mortgage deposit is 15% of the property value (85% LTV).

The rental amount can limit the greatest loan achievable, requiring higher deposits. Landlords with larger deposits can enjoy better Company HMO Mortgage products and rates.

🔷Can I get an Interest Only Limited Company HMO Mortgages?

Yes. You can obtain Interest Only Limited Company HMO Mortgages or on Repayment. Whichever suits your requirements and risk profile.

🔷Will the lender require a personal guarantee?

Yes. When you buy an HMO through a limited company the directors and shareholders sign a personal guarantee.

This requirement is rarely waived. Unless it is very low LTV or the company owns other unencumbered assets. In such cases, a charge on the company as a whole will be taken.

Asking a lender to take a risk by lending you the money. Except do not to give those same guarantees. As you imagine is not looked upon fondly.

🔷Can I get an HMO Licence in a Limited Company?

Your HMO Licence will require a "responsible person" this can be you or your letting agent. The licence is for the property and to ensure the responsible person is fit and proper.

So a company can have a Licensed HMO Property, though it won't hold the licence itself. You will.

🔷Should you buy an HMO in a Limited Company?

As the Government looks to take more of your rental income, landlords like you are looking at HMOs to increase rental yield. The question then is if you should buy the HMO in a Limited Company?

The primary reason for setting up an HMO Investment Company is to help manage your tax affairs. Your first stop should be your accountant.

Limited Company HMO Mortgages often have higher fees or rates. We work with you and your accountant to help them calculate the best.

Though its not all about tax...

The benefits for some are clear, the ability to retain profits. The ability to keep personal taxation low or keep yourself under a tax bracket. Was the main benefit when the Government changed how on the rental income you are taxed. The ability to deduct mortgage interest relief.

Other reasons include being able to pass on the shares of a company to a family member. While you may want the flexibility of bringing in shareholders to raise funds.

Should you buy an HMO in a Limited Company? Can only be answered if you have identified a benefit in doing so.

One landlord tells us, it's to stop worrying about utility providers affecting her personal credit score if a tenant fails to settle their final bill.

🔷Step-by-Step Guide to buying through a limited company

Step 1 - Are you sure?

There are costs in moving a property from a personal to a limited company. The first step is to ensure you know the advantages and disadvantages. Proceeding with the best course from the outset.

Changing your mind later and moving property can result in Capital Gains Tax and Stamp Duty (SDLT). It's also not a one or the other choice. If you are a portfolio landlord you can have some in personal name and some in a limited company.

Step 2 - Incorporate a company.

You can Incorporate a limited company, a brand new one. Online, via your Mortgage Adviser or Accountant.

Mortgage lenders do not like lending to existing companies (doing other activities). You would not use the existing company but set up a new company. A Special Purpose Vehicle (SPV) used for Buy-to-Let only.

You first need a suitable company name, that is not used by any other company. It can not suggest any other business activity. "Bobs IT Consultancy Limited" won't work. Trademark names such as "Burger King Homes Limited" won't be acceptable.

You can Search the Register ( https://beta.companieshouse.gov.uk/ ) to see if a name is available.

On registration, you need to know the:

- Address of the company - This can be your house, your accountants or another address.

- At least one named Director - Can be up to 4.

- The shareholding split of the company - can be up to 4 shareholders.

- For every shareholder and director - Date of Birth, Place of Birth and Residential Address.

When you create the company, it will ask for your SIC Code. This identifies what company activity you will be doing. The SIC Codes you want are:

- 68209 – Other letting and operating of own or leased real estate.

- 68100 – Buying and selling of own real estate as well but Limited Company

You only want these activities, you don't want any more. Don't use others that contradict the company activity. Mortgage lenders won't like it if you also include Plumbing, etc.

You can use the standard memorandum and articles of association. No special changes are needed to the provided articles.

Step 3 - Set up a Business Bank Account

Company formation can take up to 48 hours. Once you have your company number, you can set up a bank account.

Your income and expenditure will go through this bank account. Such as mortgage payments and rental income. You can not use your personal bank account for mortgage payments.

You can ask your prefered bank - HSBC, Barclays, Santander or whomever. An appointment may take a while and you need the bank account to get the mortgage offered

If your bank is too slow. You can consider online banks such as Starling Bank or Monzo Bank for easy and quick setup.

Step 4 - Limited Company Buy to Let Mortgage

You need to tell your mortgage adviser from the outset. That you want a limited company buy-to-let mortgage. This is because not all buy-to-let lenders offer limited company mortgages.

The lenders that do offer the facility, often have the same products for a company or personal. Though not all and may result in higher rates or fess than in personal name.

The process is similar. You will receive a Key Facts Illustration (KFI) outlining the costs. On confirmation, your mortgage broker will proceed to an Agreement in Principle (AIP). Then onto a full mortgage offer and finally completion.

Step 5 - Conveyancing

Your small residential conveyancers may not have experience in Limited Company Buy-to-Let. It requires extra work with Companies House, Personal Guarantees and so forth.

Mortgage Lenders, due to the specialist work, have a panel of prefered conveyancers. Ask your mortgage broker if the conveyancer is on the Lenders panel or ask for a recommendation.

Considering the extra work, conveyancers may charge on average an extra £200 for works.

Your mortgage lender will want you to sign a "Personal Guarantee". One condition is you receive solicitors advice on the Personal Guarantee. The issue is it can not be the same solicitor your company is using.

Ask your mortgage adviser or conveyancer recommendations for a Personal Guarantee Solicitor. Prices range from £150 to £500.

Step 6 - Deposit

Before mortgage completion, you will need to send deposit money to your Conveyancer. You should talk to your accountant if that should be a "Gift" from you to the company or a "Loan". Each has different tax implications.

As with any mortgage, money laundering will need you to evidence the source of funds. Such as savings, inheritance or sale of another property.

Is your deposit coming from another company you own? talk to your broker about the lender's requirements. You may be able to loan it from one company to another, though most will need it to be a dividend to you. Then gifted or loaned from to the company.

Step 7 - Insurance

Before mortgage completion, you will have to have buildings insurance in place. This is a mortgage offer rule. The insurance needs to be in the company name, not your personal name.

Your mortgage adviser can help you get quotes. The insurer listing the company as a party to the insurance does not add costs.

Step 8 - Completion

Congratulations! Remember the company is a "separate legal entity". Your money is not its, and its money is not yours. You should pay all costs and receive income into the company bank account for simplicity. This will help you when filing accounts.

Your company may not have any money from the outset, to pay insurance, mortgage fees or renovation. You can gift or loan it from your personal funds to the company.

Try and keep it as simple as possible. Your accountant will thank you for separating personal and company finances.

🔷Talk to our HMO Mortgage Advisers

-

Buy-to-Let Mortgage >

Dive into property investment with our Buy-to-Let Mortgage, tailored for both seasoned investors and first-timers seeking to build a profitable portfolio.

-

Buy-to-Let Remortgage >

Maximize your investment with Buy-to-Let Remortgage, ensuring optimal returns by refinancing your property portfolio with competitive rates.

-

Buy-to-Let Rate Switch >

Enhance your property investment strategy with a Buy-to-Let Rate Switch, ensuring you stay competitive in the market with a smart financial move.

-

Buy-to-Let Company Mortgage >

Optimize your property portfolio's potential with a Buy-to-Let Mortgage in your SPV Company Name, combining strategic investments with simplified financial structures.

-

Portfolio Mortgages >

Grow and diversify your property portfolio with our Portfolio BTL Mortgages, offering tailored solutions for seasoned investors aiming for prosperity.

-

Holiday Let Mortgage >

Transform your vacation home investment dreams into reality with a Holiday Let Mortgage,

-

HMO Mortgage >

Unlock the potential of shared living spaces with our HMO Mortgage, tailored to support your investment in Houses in Multiple Occupation.

-

HMO Company Mortgage >

Elevate your HMO investment strategy with our HMO Mortgage in your SPV Company Name, combining strategic planning with streamlined financial structures.

-

HMO Remortgage >

Revitalize and optimize your HMO investment with a strategic HMO Remortgage, ensuring your shared living spaces remain lucrative in the market.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX