Limited Company Buy to Let - Advantages and Disadvantages

In 2000 there was no more than 5,000 Limited Company set up for Buy-to-Let, in 2017 just seven years later 35,000 were established. The increase came about due to the Conservative 2015 Summer Budget reducing mortgage interest relief for landlords holding property in a personal name. Limited Company Buy-to-Let became an overnight hit.

Except, the taxation change does not make Limited Companies the right choice for all Landlords.

On Landlord Taxation alone it's not a binary choice, property accountants recommend each avenue depending on your circumstances and plans.

This article on Limited Company Buy-to-Let Advantages and Disadvantages is here to outline areas of discussion you should be having with your property accountant when making that determination.

Advantages

Higher Tax Relief

From 2017 to 2020 the amount of Buy to Let Tax relief individual landlords can claim back will progressively cut from a maximum of 45% to 20% for high rate taxpayers. However, this change does not affect Limited Companies. Therefore if you are a top rate taxpayer, the tax payable via a Limited Company will be lower than the tax on individual income.

No tax on dividends <£5,000 for individuals

From April 2016, the Dividend Tax Credit will be replaced by a new tax-free Dividend Allowance of £5,000. This means you can potentially receive tax-free dividend income from your investment properties

No income tax when reinvesting profits to secure further properties

You can grow your BTL portfolio more quickly within a Limited Company as there will be no income tax on the retained profit, thus allowing more cash to re-invest. Although corporation tax is payable on trading profits (20%; 2015/16 reducing to 18% by 2020), this is lower than the higher income tax rate (40% for £31,786 to £150,000; 2015/16).

Personal funds can be drawn back out of the company

Any investment you make into the Limited Company (e.g. the mortgage deposit), they can pull back out of the company if classed as a Director's Loan. (This is lender specific, as your Buy to Let Mortgage Broker if applicable.)

Potential Personal Tax Savings

The rate of Corporation Tax is currently 20% which means your tax liability is reduced compared to if you are paying income tax as a higher rate taxpayer at 40%.

With funds being able to be retained in the limited company you can control how much income is taken personally, therefore, reduce your potential income tax liability.

Easier Change of Ownership

The company will own the property - the companies directors or shareholders can be changed. You can, therefore, add or remove owners to suit your situation.

Perhaps adding a new partner to receive investment funds to expand the portfolio or buying out old partners. Changing ownership via companies house forms being a lot simpler than changing ownership of a property by sale.

Personal Expenditure

If mortgages are held in a Limited Company, mortgage lenders may not take these into account as commitments and therefore allow increased private borrowing. Instead, you will have an additional income entry on your application form.

Not In My Name

The limited company will own the property - As experienced landlords can attest utility companies and council tax will find your name to try and hold you liable for tenant debts to obtain payment. As they write letters to the property, this can often lead you a mark on your credit file.

With Limited Companies, the name on Land Registry documents will be that of the company reducing this risk and given that little bit of privacy.

Disadvantages

No Capital Gains Tax (CGT) allowance when the company sells a property

When a company sells a property, there is no personal Capital Gains Tax, Whereas individuals selling property would have £11,100 CGT allowance (2015/16)

Property Transfer Costs

If you want to transfer existing properties into the company, you will incur Stamp Duty Land Tax, Legal Costs, Higher Rates and potentially Capital Gains Tax.

It is currently not advised to transfer properties you already own into a Limited Company. This should always be an exercise with your accountant to establish a benefit analysis, to compare the costs and potential savings.

Administrative Tasks

Dealing with HMRC, Completing Annual Returns and Company Accounts. It's not so much as a disadvantage as an increased burden of doing business and the extra cost of a good accountant to help you meet company requirements.

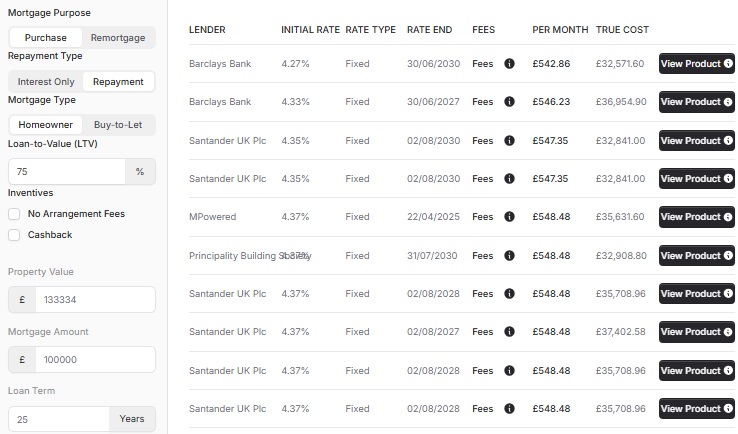

Higher Mortgage Rates

Most mortgage lenders with a few exceptions charge higher interest rates and fees for Limited Companies than they do in personal names due to extra work involved. A cost-benefit analysis should be completed to compare the increased mortgage costs compared to the potential tax savings.

Reduced Lender Choice

There are many lenders happy to lend for Buy to Let in your names, many of those lenders currently do not offer Limited Company Buy to Let Mortgages.

With the budget changes, more are entering the market which leads to a diversified choice and criteria.

Higher Legal Costs

Conveyancers often charge an extra fee for Limited Companies due to the extra workload involved such as registering mortgages at Companies House and ensuring Money Laundering Regulations are met.

Personal Guarantees

In the typical article on Business v Sole Trader - you are usually told that a Limited Company gives you personal liability from its creditors. This remains with Company Buy to Let with one big exception - your mortgage lender will want a "Personal Guarantee" which is you agreeing to be liable for the mortgage debt of the company.

Privacy

Your tax documents are between you, your accountant and HMRC. A limited company has to publish its accounts, available online at Companies House showing your property portfolio company financial status to the public.

Releasing Equity

Landlords have long enjoyed issuing equity from a property on refinancing - especially in areas of good capital appreciation. Especially useful for the new car, holiday or home extension. With limited company property, you can still release equity, but those funds are that of the company - to be re-invested - if you want those funds personally it will be classed as income and taxed appropriately.

..... One more thing.

Once you purchase a property in a Limited Company, that Limited Company can be used again and again to expand your portfolio.

What mortgage lenders are not fond off are Limited Company's that conduct other business actives. As such you may find mortgage lenders insisting that you purchase property in a Special Purpose Vehicle.

A Special Purpose Vehicle in this context means a company's business activities are limited to buying and renting out property, they do not want you to do other activities such as starting to manufacture widgets.

In Conclusion

Choosing to buy a property in a Limited Company or Personal Names is not a simple decision to make. There are many advantages and disadvantages in each scenario and it is not focused only on Tax Planning.

It is a discussion that you need to have with your Accountant, Mortgage Broker and bearing in your goals.

What are others saying?

Accountants Nunn Hayward LLP on Estate/Inheritance Tax Planning says "Multiple ownership of property beyond a couple becomes very complex. Where a property portfolio is being built, owning properties under one single company and planning with the shares in that company can be a lot more straight forward if, for instance you wished to pass on a small fraction of value to family members or create tax-efficient structures using Trusts during your lifetime or through your Will. Use of companies opens up other possible planning, that is beyond the scope of this overview."

Trained Accountant Alister Wood says "Annual Tax on Enveloped Dwelling (ATED) does not really come into play unless you use a property for own benefit (i.e. stay in it etc.) or rent to a connected party such as a family member. If you rent to the non-connected party or are developing the property, then you fill in a form to exempt you from the charge."

Is Conveyancing more expensive for Limited Company Buy to Let?

With thanks to George Osborne and his tax plans, the number of property investors asking for Limited Company Mortgages has risen.

I am no expert in tax - but - I understand it is the benefit of retained profits in the LTD Company allowing property investors to lower their tax return therefore perhaps keeping out of the 40% bracket.

I was asked a question "Why are solicitors more expensive for Company Buy to Let?" the short answer is it is more comprehensive searches.

Luckily for us Edward Goldsmith, partner, Goldsmith Williams outlined that conveyancers acting for lenders must conduct extra due diligence including:

- Obtaining the memorandum and articles of association and certificate of incorporation to ensure the company has the power to borrow money and hold property

- Acquiring full identification and consent from Company Directors.

- Acquiring full identification and consent from Company Shareholders or beneficial owners.

- Personal Guarantees from Company Directors.

- Personal Guarantees from Company Shareholders.

- Conducting a company search for other borrowings and orders

- Obtaining the current annual return for the company.

- Scrutinizing the latest company annual report and accounts to ensure the company is solvent

- satisfying themselves, lender requirements and money laundering requirements regarding the source of the funds

- and conducting any other searches and investigations that the particular transaction dictates

The lender’s lawyers must also comply with the requirements of Companies House to register the charge within the prescribed 21 days and satisfy any Land Registry requirements to register the property.

Whether establishing a limited company will be beneficial for the individual buy-to-let landlord will depend on their circumstances, both financial and legal.

Some items Edward Goldsmith outlines become less burdensome if you purchase in a Special Purpose Vehicle established by your Mortgage Broker at the time of application; for instance, using standard Memorandum and Articles, a new SPV will have no borrowings, no annual returns or accounts and the shareholders/directors all clearly party to the transaction.

Whilst simpler with a Special Purpose Vehicle Buy to Let - the checks will still be required.

-

Buy-to-Let Criteria

>

Navigate the world of property investment confidently with our Buy-to-Let Criteria, ensuring you meet the standards for unlocking lucrative opportunities.

-

Buy-to-Let Affordability

>

Achieve investment success with Buy-to-Let Criteria Affordability, ensuring your property ventures align seamlessly with your financial capabilities.

-

Buy-to-Let Minimum Deposit

>

Your Guide to the Minimum Deposit required to get into Buy-to-Let.

-

Buy-to-Let for First Time Buyers

>

Embark on your property investment journey confidently with Buy-to-Let for First Time Buyers, tailored to guide newcomers towards their first lucrative investment.

-

Buy-to-Let Personal Guarantee

>

Your Guide to Personal Guarantees and Buy-to-Let.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX